Correction of Errors in Accounting Questions

What you will learn in FA. The post GMAT Sentence Correction Practice Questions is an excellent resource.

Samacheer Kalvi 11th Accountancy Solutions Chapter 9 Rectification Of Errors Samacheer Kalvi Guru Accounting Classes Accounting Principles Journal Questions

Financial Statement Presentation of Fee Waivers Correction of Errors and other topics.

. Furthermore the number of transactions entered as the debits must be equivalent to that of the credits. For more information about Social Security numbers read our Social Security Number Randomization Frequently Asked Questions. A supercomputer can process trillions of instructions in a secondIt has thousands of interconnected processors.

Section B will contain 2 fifteen-mark multi-task questions. Frequently Asked Questions about the Delinquent Filer Voluntary Correction Program. Journals also refer to the books of first entry such as the cash receipts journal the general journal and more.

Hello I have a problem with the errors questions on my accounting work with this topic. Check for 390 incorrectly recorded by the company as 930. Record any portion of the correct related to prior fiscal years in the first interim period of the current fiscal year.

APPENDIX D SUMMARY OF THE FASBS IASC US GAAP. There are 49 grammar questions on the SAT writing section. There are many types of errors that can occur in a sentence and we will try to cover most of them here.

A sentence is a group of words that have a syntax and convey a certain meaning. For example the mistake in the previous example was made in 2017. ACCOUNTING AND DISCLOSURE INFORMATION.

Questions will assess all parts of the syllabus and will test knowledge and some comprehension or application of this knowledge. Errors and discrepancies intentional or unintentional should be detected investigated and resolved in a timely fashion. The way around this is to add backdated correcting entries.

Grammar accounts for over two thirds of the marks on this section. Subsidiary entries are transactions that arent recorded correctly. Errors from the previous year can affect your current books.

Frequently Asked Questions on IM Guidance Update 2016-06 Mutual Fund Fee Structures Last Updated. Once you got the financial accounting mcq Old Papers with Solutions Pdf you can check the answers for the questions also. Fortunately changes to IAS 8 effective from 2023 clarified that the effects on an accounting estimate of a change in an input or a change in a measurement technique are changes in accounting estimates unless they result from the.

Applied For in Box d on the paper Form W-2. It can be prepared only in those concerns where the double-entry system Double-entry System Double Entry Accounting System is an accounting approach which states that each every business transaction is recorded in at least 2 accounts ie a Debit a Credit. A strong skills section on your resume can be your employers first introduction to your qualifications as a candidate.

On the basis of size the computer can be of five types. The aim of ACCA Financial Accounting FA F3 is to develop knowledge and understanding of the underlying principles and concepts relating to financial accounting and technical proficiency in the use of double-entry accounting techniques including the preparation of basic financial statements. Forms W-2 Submitted to Social Security on Paper If you still do not have an employees SSN when your Form W-2 report is due complete the SSN field by entering.

Guidance for each of these types of changes is presented in separate headings. Read through this first lesson on basic accounting journal entries for a review of the ten most common journal entries. Typically you should include both hard skills and soft skills since they each indicate how likely you are to fulfill the responsibilities of your role and collaborate with your coworkers.

Identification of sentence errors. What is the Delinquent Filer Voluntary Compliance Program DFVCP. It compiles links to other blog posts listed by the rule that they have to do with.

3 A check for 180 in payment of an account was erroneously recorded in the check register as 810. GAAP copyrighted by the Financial Accounting Standards Board Norwalk Connecticut USA 1999Please note that the attached. JAL will resume publication in 2022 with its 44th.

This document is an excerpt from the FASBs The IASC-US. So if you wanted to learn about gerunds and gerund phrases or when to use like vs. Questions are of 3 types.

The journal remains a committed interdisciplinary forum for papers which make a fundamental and substantial contribution to the understanding of accounting phenomena. To make the correction add the 1000 debit and credit dated December 31 2017. Emerald is pleased to announce its recent acquisition of the Journal of Accounting Literature which was established in 1982 by the University of Florida.

Hence its time to read the financial accounting mcq Model Papers. In this article well discuss the top skills to list on an accounting resume. First why not check out some sample questions.

This mistake is only normally discovered during a bank reconciliation according to The Balance. Restate prior interim periods to include that portion of the correction applicable to them. In this lesson we will discuss the correction of errors in language instruction.

Include that portion of the correction related to the current interim period in that period. As you can go to a post that focuses on that rule with examples. Correcting these errors can be explicit or implicit.

Supercomputers are the biggest and fastest computersThey are designed to process huge amount of data. Provided that the prior period erroradjustment shall be corrected by retrospective restatement Restatement A restatement is the revision of already issued financial statements of one or more companies to correct errors with material inaccuracy due to non adhering and complying with the GAAP accounting mistakes fraud or clerical errors affecting part of the entire financial. Review source documents to assure they are processed and.

A Report on the Similarities and Differences between IASC Standards and US. Sentence correction improving sentences Editing in context improving paragraphs. Department of Labor Employee Benefits Security Administration January 27 2020.

Well run through each of these in the second lesson on accounting journals where youll get a good idea of what each one is for its format and how it. That said the first step in correcting accounting errors is to identify those. 2 Check for 50 incorrectly charged by bank as 500.

The examination will consist of two sections. In an effort to encourage pension and welfare plan administrators to file overdue annual reports. So we decided to help the candidates with information related to financial accounting mcq previous year questions.

These will test consolidations and accounts. For example these question 1. We will explore what that.

For example an invoice is entered in accounts receivable as 10000 instead of the 1000 actually owing. Section A will contain 35 two-mark objective test questions. As questions on sentence correction are very frequent in several competitive exams we will cover such questions here in this section.

Verify the recording of transactions in a timely manner. An accounting change can be a change in an accounting principle an accounting estimate or the reporting entity.

Correction Of Errors And Suspense Account Ppt Video Online Download

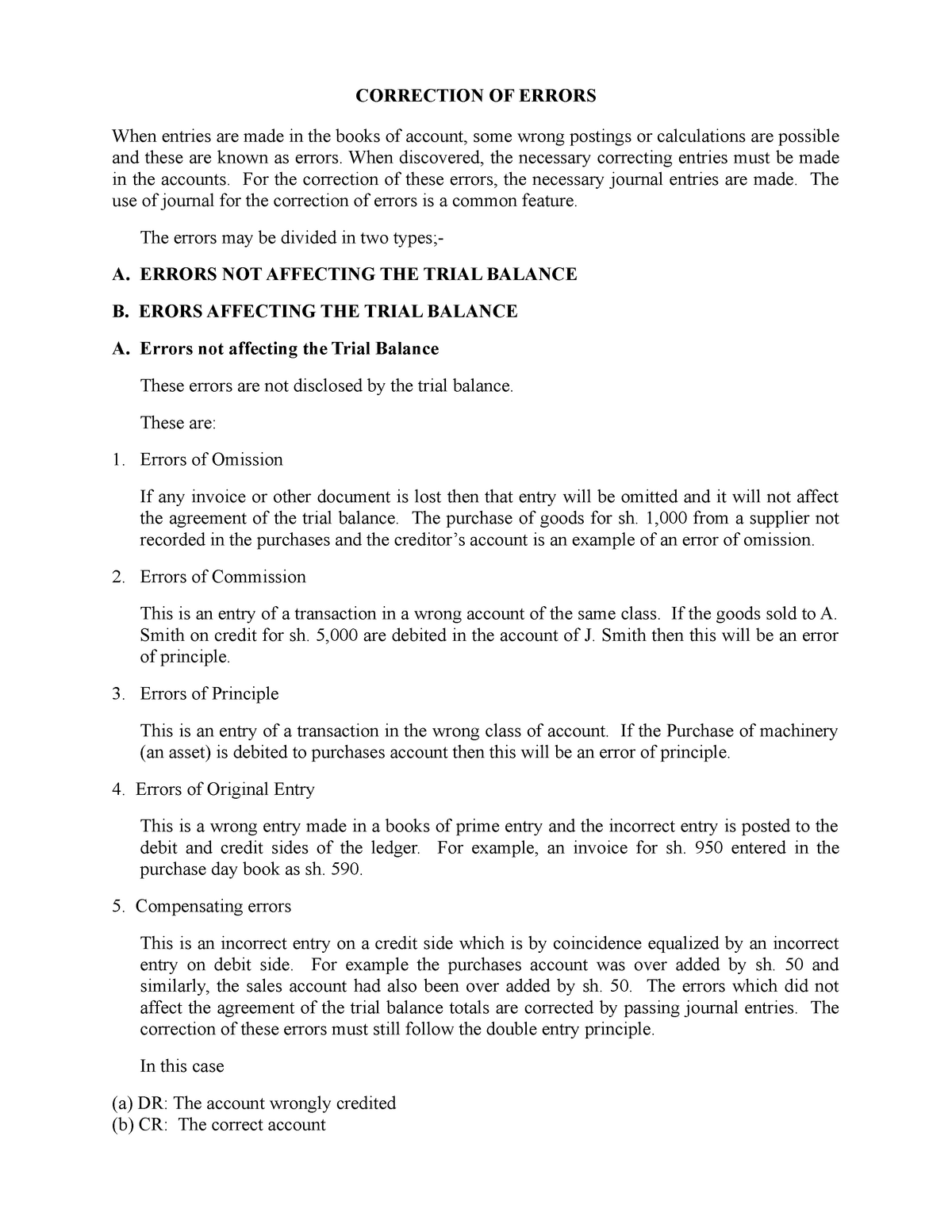

Correction Of Errors Lecture Notes 6 Correction Of Errors When Entries Are Made In The Books Of Studocu

Accounting Errors And Corrections Double Entry Bookkeeping

Trial Balance And Rectification Of Errors Mcqs Trial Balance Financial Accounting Trials

No comments for "Correction of Errors in Accounting Questions"

Post a Comment